What is a Shooting Star Candlestick Pattern May 2023

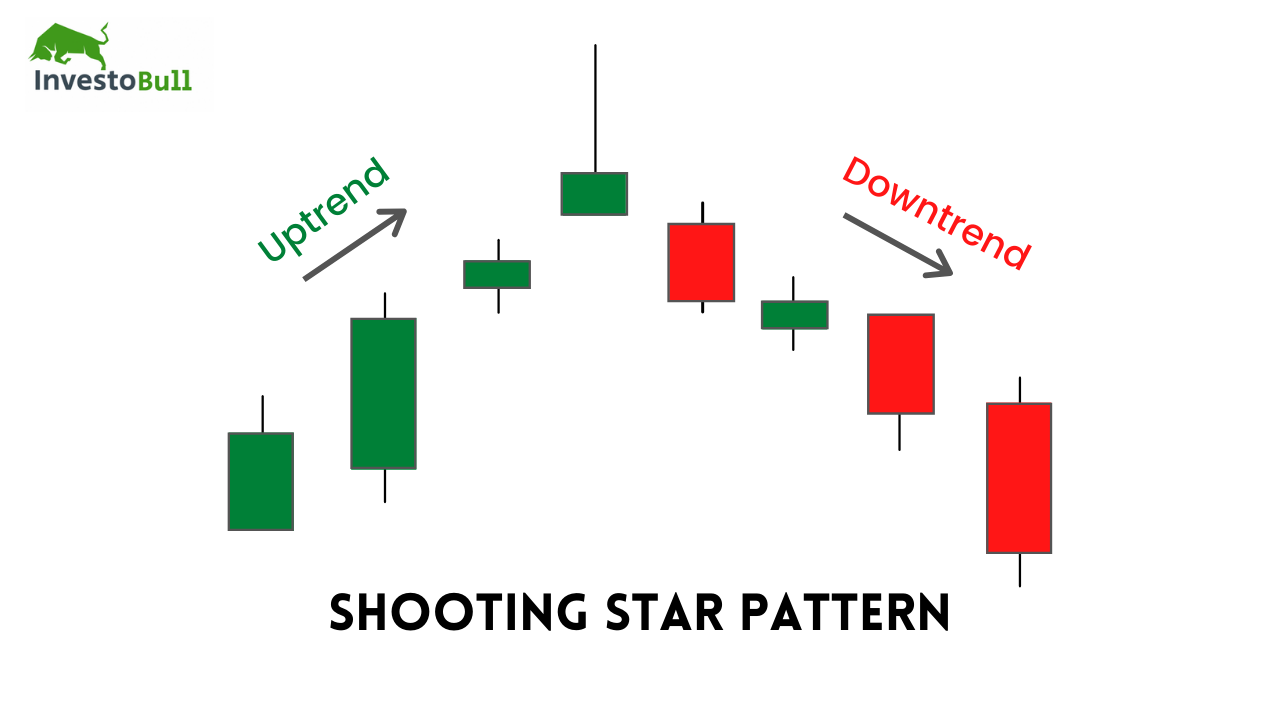

The shooting star pattern is a bearish reversal pattern that consists of just one candlestick and forms after a price swing high. It is seen after an asset's market price is pushed up quite significantly but then gets rejected at higher prices, which indicates that the price may be about to decline.

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals Bybit Learn

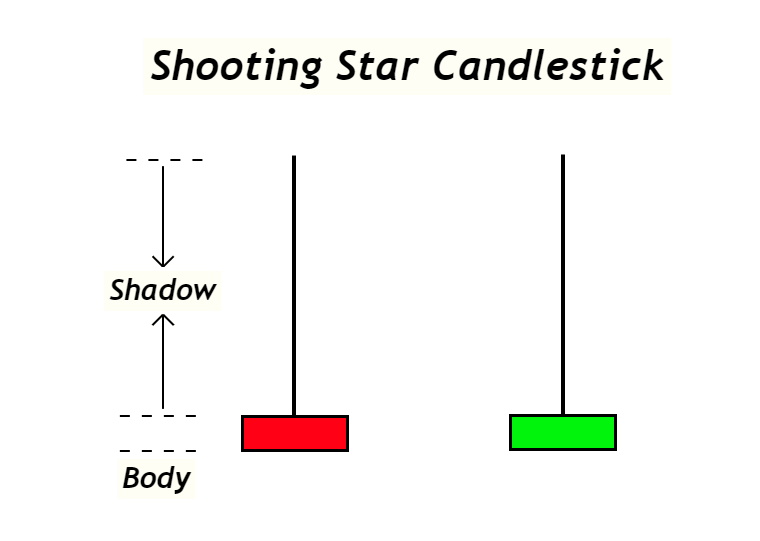

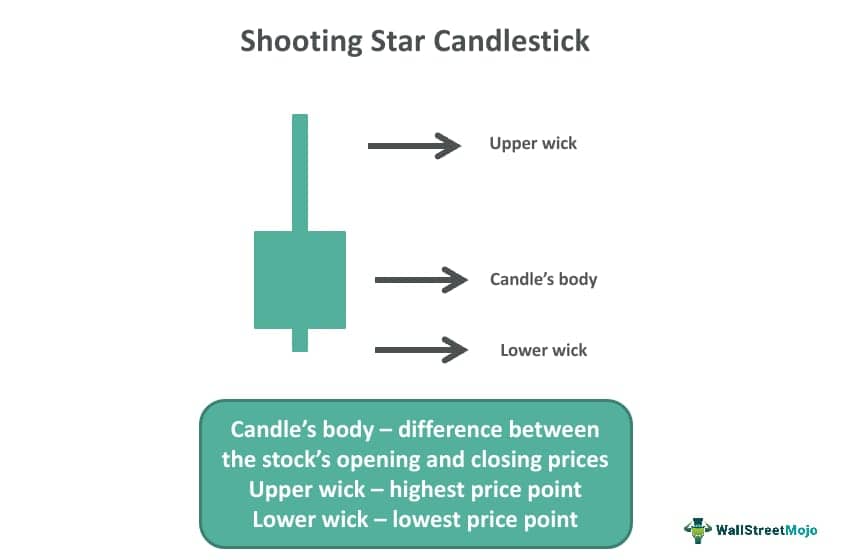

A shooting star candlestick is a type of price chart pattern that is created when a security's price increases initially after opening and then falls close to the opening price before the market closes. A shooting star candlestick is structured by a small body, a long upper shadow or wick indicating the increase in price and buying pressure.

What Is Shooting Star Candlestick With Examples ELM

The shooting star pattern is one of the most common and popular candlestick patterns. With their clear and colorful way of representing market action, candlestick charts have come to dominate among new traders who wish to spot patterns in the market. A shooting star is a single-candlestick pattern that forms after an uptrend.

Shooting Star Candlestick Pattern Forex Trading

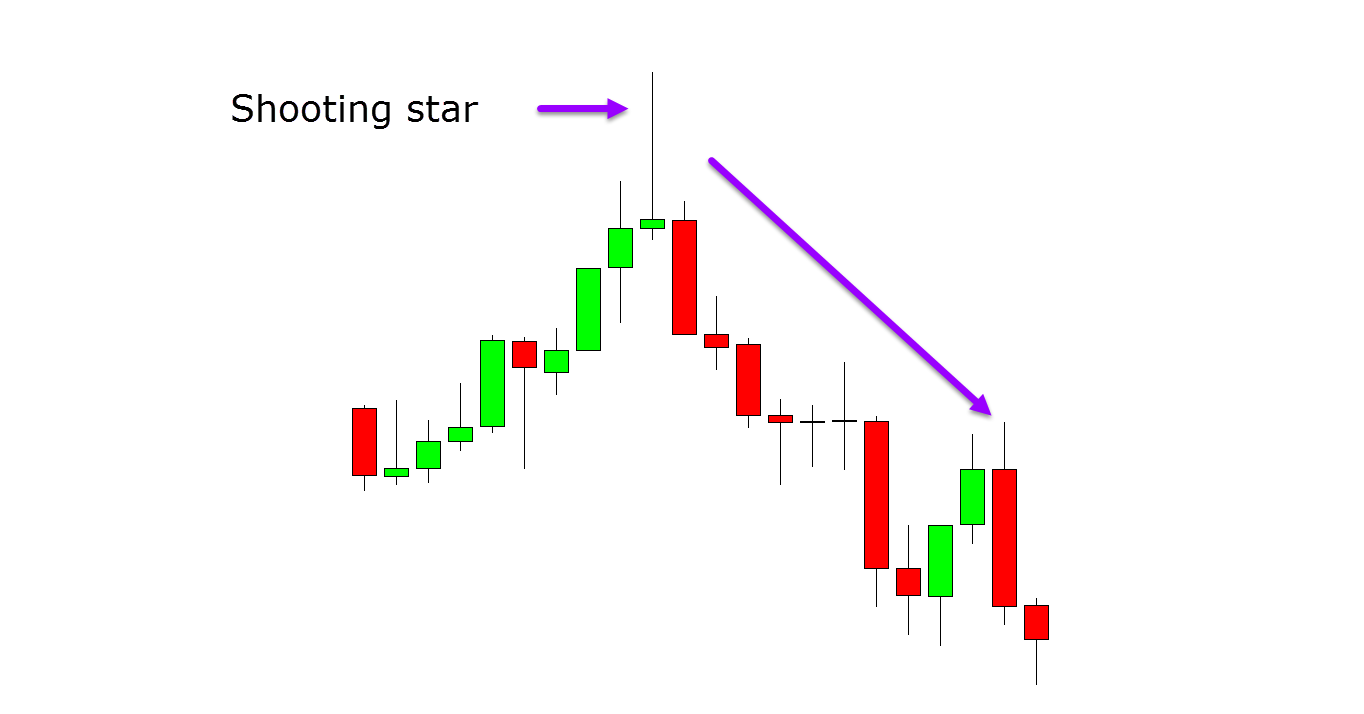

A shooting star candlestick is a Japanese candlestick pattern that appears when the security price rises significantly, but the closing price falls and lands close to the opening price. The bearish shooting star candlestick pattern appears towards the end of an uptrend to indicate a forthcoming trend reversal.

Shooting Star Candlestick Pattern How to Identify and Trade

The Shooting Star is a Japanese candlestick pattern. It's a bearish reversal pattern. Usually, it appears after a price move to the upside and shows rejection from higher prices. The pattern is bearish because we expect to have a bear move after a Shooting Star appears at the right location.

Shooting Star Candlestick Pattern Trading the Shooting Star Candlestick Pattern (Pinbar

The Shooting Star pattern is considered a bearish candlestick pattern as it occurs at the top of an uptrend and is typically followed by the price retreating lower.

Shooting Star Candlestick Pattern How to Identify and Trade

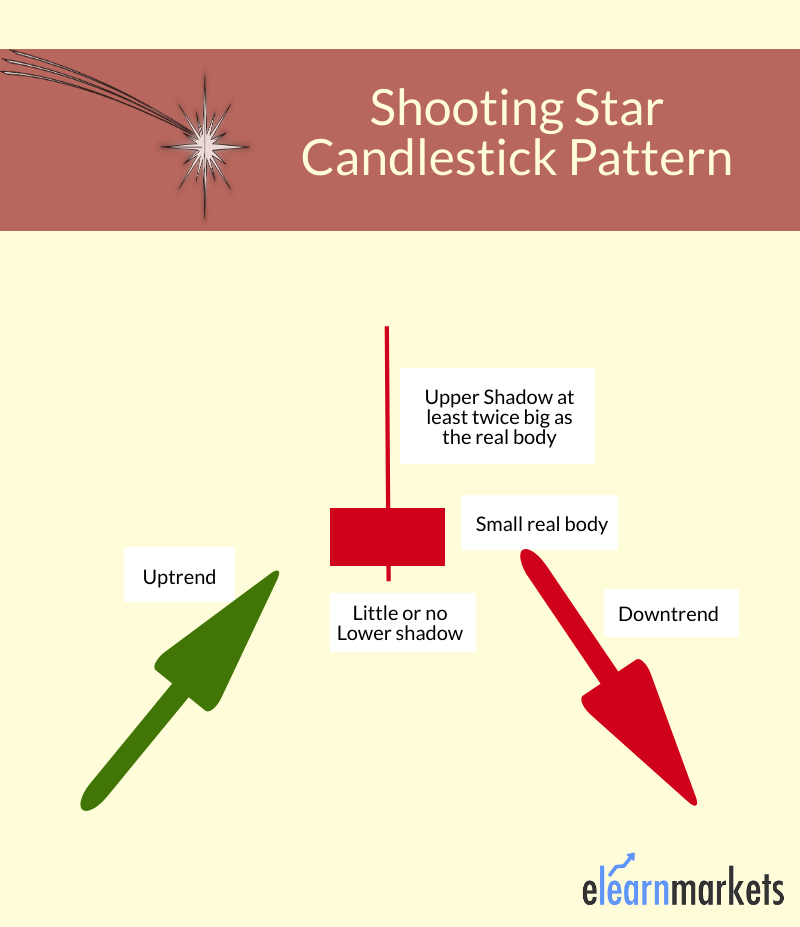

September 3, 2022 Zafari. The Shooting Star Candlestick Pattern is a single reversal candlestick that forms at the top of a trend. It suggests a future downtrend. In other words, a shooting star candlestick is a single bearish pattern. A shooting star has a long upper shadow/tail and a small body at the bottom of the candle, with or without a.

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

The Shooting Star is a candlestick pattern to help traders visually see where resistance and supply is located. After an uptrend, the Shooting Star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited.

Shooting Star Candlestick Pattern Meaning, Chart, How To Trade?

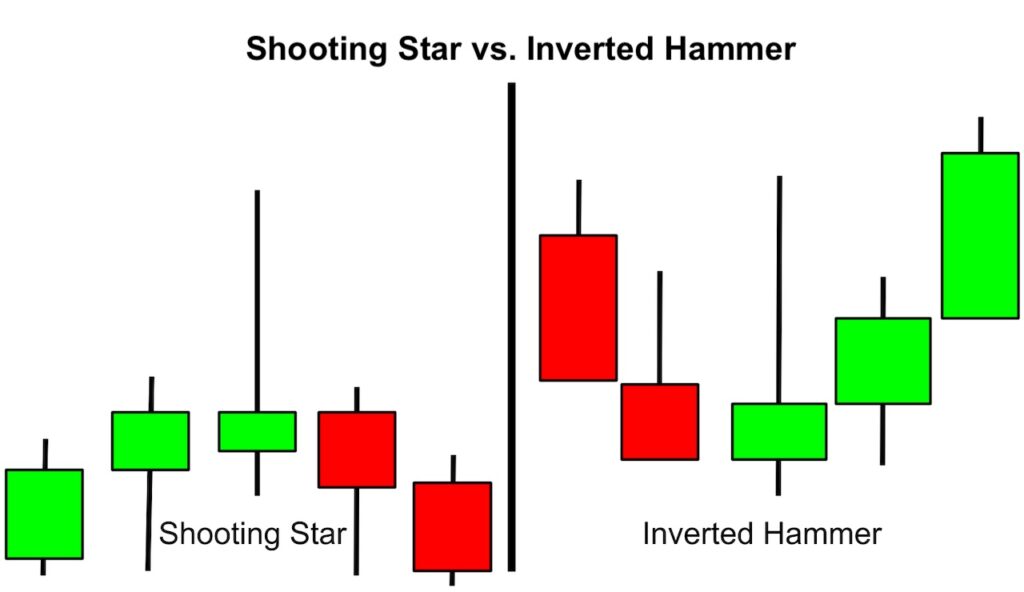

In technical analysis, a shooting star is interpreted as a type of reversal pattern presaging a falling price. The Shooting Star looks exactly the same as the Inverted hammer, but instead of being found in a downtrend it is found in an uptrend and thus has different implications.

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals Bybit Learn

The Shooting Star candlestick pattern is a bearish reversal pattern that occurs at the top of an uptrend. It is a single candlestick pattern that is formed when the open, high, and close prices are all relatively close together, but the candle has a long upper shadow (wick) that is at least twice the size of the real body (the difference between the open and close prices).

Shooting Star Candlestick Pattern Beginner's Guide LiteFinance

The shooting star is actually the hammer candle turned upside down, very much like the inverted hammer pattern. The wick extends higher, instead of lower, while the open, low, and close are all near the same level in the bottom part of the candle. The difference is that the shooting star occurs at the top of an uptrend.

How to Trade the Shooting Star Candlestick Pattern IG Australia

In technical analysis, a shooting star candlestick is a bearish reversal pattern that forms after an uptrend. The meaning of the shooting star candlestick pattern is that buying pressure is starting to dissipate and a potential trend reversal may be on the horizon.

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals Bybit Learn

The shooting star candle is a reversal pattern of an upwards price move. The inverted hammer occurs at the end of a down trend. That being said, you can also have variations of the two. For example, you can have a hammer candlestick pattern at the top of an uptrend which will also signal a reversal.

What Is Shooting Star Candlestick? How To Use It Effectively In Trading

A shooting star candle is a bearish reversal candlestick chart pattern that often occurs at the end of an uptrend. It has a distinct shape characterized by a small real body near the bottom of the candle and a long upper shadow (wick) that is at least twice as long as the real body.

Shooting Star Candlestick Pattern

What is a shooting star candlestick pattern? Also know as the bearish pin bar, the shooting star candlestick pattern is a bearish reversal formation that consists of just one candlestick and usually forms after a price swing high.

Powerful Shooting Star Candlestick Formation, Example & Limitations2022

What is Shooting Star candlestick? As the name implies, Shooting Star means to shoot a star. This is a special Japanese candlestick pattern. They usually appear at the top of the candlestick chart. This candlestick is a good signal for you to open profitable DOWN orders. What Is Shooting Star Candlestick?